jones financial plan for nonprofit organizations When it comes to managing finances in nonprofit organizations, having a solid financial plan is essential for long-term sustainability and growth. The Jones Financial Plan offers a structured approach tailored specifically for nonprofits, helping them to navigate the complex landscape of fundraising, budgeting, and financial management. This guide will explore the intricacies of the Jones Financial Plan, offering insights, tips, and strategies to ensure your nonprofit thrives.

Understanding the Jones Financial Plan

The Jones Financial Plan is not just a set of guidelines; it’s a holistic approach to financial management that empowers nonprofit organizations to achieve their mission while maintaining financial health. At its core, this plan emphasizes the importance of creating a clear vision, developing a robust budget, and establishing sound financial practices.

A Vision for Financial Health

Every successful financial plan starts with a vision. For nonprofit organizations, this means clearly defining the mission and objectives. The Jones Financial Plan encourages nonprofits to articulate their goals in a way that resonates with stakeholders. This includes not only the board of directors but also donors, staff, and the community served.

When organizations have a clear vision, it helps align financial decisions with their overarching goals. This alignment is crucial for attracting funding, as donors are more likely to contribute to causes that have a defined impact. In practical terms, this means creating a mission statement that reflects the organization’s values and objectives. A well-crafted mission statement serves as a guiding star for financial decisions, ensuring that every dollar spent aligns with the nonprofit’s goals.

The Importance of a Robust Budget

Once a vision is established, the next step in the Jones Financial Plan is developing a comprehensive budget. A robust budget acts as a roadmap for financial decision-making, allowing nonprofits to allocate resources efficiently and effectively. The budgeting process should involve a thorough analysis of both income and expenses.

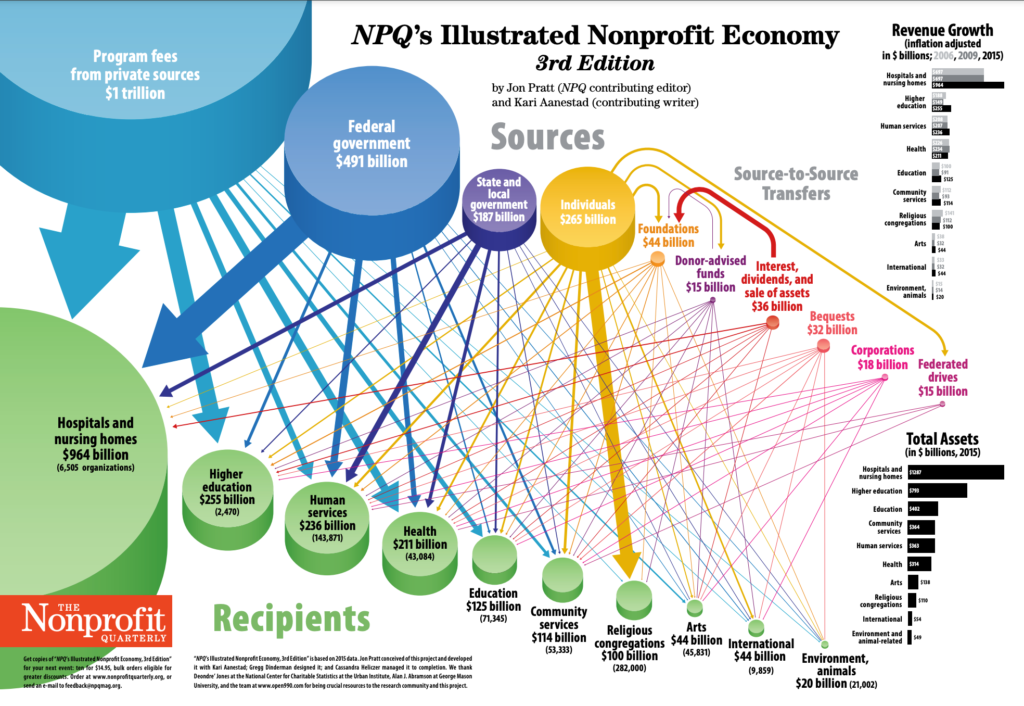

Nonprofits typically rely on a mix of funding sources, including grants, donations, and service fees. The Jones Financial Plan emphasizes diversifying revenue streams to minimize risk. By identifying potential funding sources and creating a budget that reflects these opportunities, organizations can ensure they are not overly reliant on any single source of income.

Additionally, the budgeting process should include projections for both the short and long term. This forward-looking approach allows nonprofits to anticipate potential challenges and make informed decisions about resource allocation. It’s also important to incorporate flexibility into the budget, allowing for adjustments as circumstances change.

Establishing Sound Financial Practices

To support the vision and budget, the Jones Financial Plan advocates for establishing sound financial practices. This includes implementing financial controls, ensuring transparency, and maintaining accurate financial records. Nonprofits should develop policies and procedures that govern financial transactions, from budgeting to reporting and everything in between.

Having strong financial controls helps prevent fraud and ensures that funds are used appropriately. This not only protects the organization but also builds trust with donors and stakeholders. Transparency is equally important; organizations should be open about their financial situation and regularly share updates with stakeholders to maintain accountability.

Moreover, accurate financial records are essential for effective decision-making. Nonprofits should invest in accounting software or hire qualified staff to manage finances. Regularly reviewing financial reports helps identify trends, monitor progress toward goals, and make adjustments as necessary.

Fundraising Strategies Aligned with the Jones Financial Plan

Fundraising is a critical component of the Jones Financial Plan, and having effective strategies in place is vital for sustaining operations. This section will explore various fundraising methods and how they can be integrated into the financial plan.

Diverse Funding Sources

One of the key tenets of the Jones Financial Plan is the importance of diversifying funding sources. Relying on a single source of income can jeopardize a nonprofit’s financial stability. To mitigate this risk, organizations should explore multiple avenues for funding, including individual donations, corporate sponsorships, grants, and fundraising events.

Individual donations remain a significant source of funding for many nonprofits. To maximize this income stream, organizations should focus on building relationships with donors. This involves not only soliciting contributions but also engaging with donors through regular communication, updates on impact, and appreciation events.

Corporate sponsorships can provide substantial financial support, as many companies seek to engage with nonprofits as part of their corporate social responsibility initiatives. Nonprofits should actively seek partnerships with businesses that align with their mission, creating mutually beneficial relationships that enhance visibility and provide financial support.

Grants are another important funding source, but securing them often requires significant effort and expertise. Organizations should invest time in researching grant opportunities and developing strong proposals. This aligns with the Jones jones financial plan for nonprofit organizations Financial Plan’s emphasis on creating a compelling narrative that demonstrates the organization’s impact.

The Power of Events and Campaigns

Fundraising events can be an effective way to generate revenue while also raising awareness for the organization’s mission. The Jones Financial Plan encourages nonprofits to think creatively about event planning. This can range from large galas to smaller, community-focused events, all designed to engage supporters and attract new donors.

Events should be carefully planned to jones financial plan for nonprofit organizations maximize their impact. This includes setting clear goals for fundraising, identifying target audiences, and promoting the event effectively. Utilizing social media and email marketing can help reach a wider audience and encourage participation.

In addition to events, crowdfunding campaigns can be a powerful tool for raising funds. These campaigns leverage online platforms to engage a jones financial plan for nonprofit organizations broader audience, allowing nonprofits to share their mission and goals with potential supporters. The key to successful crowdfunding is creating a compelling story that resonates with potential donors, clearly explaining how their contributions will make a difference.

Building a Strong Case for Support

To secure funding, nonprofits jones financial plan for nonprofit organizations must develop a strong case for support. This is a vital part of the Jones Financial Plan, as it outlines the organization’s mission, goals, and the impact of donations. A compelling case for support not only attracts donors but also builds trust and credibility.

This document should include data and anecdotes that illustrate the organization’s impact, showcasing real-life examples of how funds jones financial plan for nonprofit organizations have been used effectively. By providing a clear narrative, nonprofits can inspire confidence in potential donors, making them more likely to contribute.

Additionally, the support case jones financial plan for nonprofit organizations should be tailored to different audiences. Understanding the motivations and interests of various donor segments allows nonprofits to present their mission in a way that resonates with each group. This personalized approach can significantly enhance fundraising efforts.

Financial Reporting and Accountability

Financial reporting is an jones financial plan for nonprofit organizations essential component of the Jones Financial Plan. Regularly reviewing and analyzing financial reports not only helps nonprofits stay on track with their budgets but also ensures accountability to stakeholders.

Understanding Financial Statements

Nonprofits should be familiar with jones financial plan for nonprofit organizations key financial statements, including the balance sheet, income statement, and cash flow statement. Each of these documents provides valuable insights into the organization’s financial health.

The balance sheet offers a snapshot of the organization’s assets, liabilities, and equity at a specific point in time. This information is crucial for understanding the overall financial position. Meanwhile, the income statement summarizes revenue and expenses over a period, highlighting profitability and operational efficiency.

The cash flow statement provides jones financial plan for nonprofit organizations insight into how cash is generated and used within the organization. This is especially important for nonprofits, as maintaining positive cash flow is essential for meeting operational needs. Regularly reviewing these statements allows organizations to identify trends, anticipate challenges, and make informed decisions.

The Importance of Transparency

Transparency in financial reporting jones financial plan for nonprofit organizations is vital for building trust with donors and stakeholders. The Jones Financial Plan advocates for regular communication about financial performance, including sharing reports and updates with board members, staff, and supporters.

Annual reports are an excellent way to jones financial plan for nonprofit organizations showcase financial health while also highlighting the organization’s achievements. These reports should include not only financial statements but also narratives that illustrate the impact of the nonprofit’s work. By making this information accessible, organizations demonstrate accountability and foster stronger relationships with stakeholders.

Additionally, nonprofits should consider undergoing independent audits. This adds an extra layer of credibility to financial reporting, as external jones financial plan for nonprofit organizations auditors can verify the accuracy of financial statements. This commitment to transparency and accountability can significantly enhance donor confidence.

Utilizing Technology for Financial Management

In today’s digital age, leveraging technology for financial management can greatly enhance efficiency and accuracy. The Jones Financial Plan jones financial plan for nonprofit organizations encourages nonprofits to invest in accounting software that streamlines processes, from budgeting to reporting.

These tools can automate many tasks, reducing the risk of human error and saving valuable time. Additionally, many accounting software solutions offer features specifically designed for nonprofits, such as tracking donations and generating reports tailored to stakeholder needs.

Cloud-based solutions also facilitate jones financial plan for nonprofit organizations collaboration among team members, allowing for real-time access to financial information. This can be especially beneficial for organizations with remote staff or multiple locations, ensuring everyone is on the same page.

Strategic Financial Planning for Long-Term Sustainability

The Jones Financial Plan goes jones financial plan for nonprofit organizations beyond short-term financial management; it emphasizes the importance of strategic planning for long-term sustainability. This involves not only managing current finances but also anticipating future needs and challenges.

Setting Financial Goals

Strategic financial planning begins with setting clear, achievable goals. These goals should be aligned with the organization’s mission and vision, providing a roadmap for financial decisions. For example, a nonprofit may set a goal to increase revenue by a certain percentage over the next few years or to build an endowment fund to secure future financial stability.

When setting goals, it’s important to involve key stakeholders, including board members, staff, and even donors. This collaborative approach jones financial plan for nonprofit organizations ensures that the goals are realistic and that everyone is invested in the organization’s financial health.

Assessing Risks and Opportunities

A key aspect of strategic jones financial plan for nonprofit organizations financial planning is assessing risks and opportunities. The Jones Financial Plan encourages nonprofits to conduct regular assessments of their financial environment, identifying potential challenges that could impact operations.

This includes analyzing economic trends, changes in funding availability, and shifts in community needs. By staying informed, organizations can proactively address challenges and capitalize on opportunities as they arise. For instance, if a nonprofit identifies a growing demand for a particular service, it may decide to allocate more resources to meet that need.

Creating a Sustainable Financial Model

Sustainability is jones financial plan for nonprofit organizations at the heart of the Jones Financial Plan. Organizations should strive to create a financial model that supports their mission over the long term. This may involve diversifying revenue streams, developing endowment funds, or exploring social enterprise opportunities.