Introduction: yahoo finance gme

yahoo finance gme In the world of stock markets, few stories have been as gripping, unpredictable, and widely discussed as the rise of GameStop’s stock. While the video game retailer was known for its physical stores and gaming merchandise, it became the face of a financial revolution in early 2021. The story of GameStop’s dramatic stock surge, driven by a group of retail investors from the Reddit community, captivated the attention of investors, financial analysts, and the media.

One platform that played a crucial role in tracking and reporting on GameStop’s stock performance was Yahoo Finance. With its user-friendly interface and real-time updates, Yahoo Finance has become a go-to resource for anyone looking to stay informed about the latest market trends. For those following GameStop’s journey, Yahoo Finance has been instrumental in understanding the stock’s meteoric rise and subsequent fluctuations. But how does Yahoo Finance track GME? What insights does it provide? Let’s take a closer look.

The GameStop Saga: From Retail Store to Stock Market Sensation

Before diving into how Yahoo Finance reports on GameStop (GME), it’s essential to understand the backdrop of the GameStop stock story.

GameStop’s Fall from Grace

GameStop, a once-prominent video game retailer, had been facing a steady decline in sales as the world moved towards digital gaming platforms. With the rise of online stores like Amazon, GameStop’s brick-and-mortar business model struggled to keep up. By 2020, GameStop’s financial outlook seemed bleak, and many analysts believed the company was on the brink of bankruptcy.

The Reddit Revolution: The Rise of GME

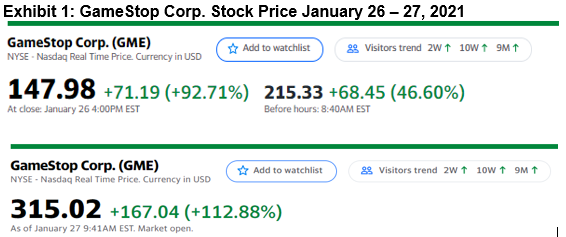

Everything changed in early 2021 when retail investors on Reddit, particularly from the subreddit r/WallStreetBets, began buying up shares of GameStop. What started as a niche movement aimed at fighting against Wall Street’s institutional investors quickly exploded into a full-blown market phenomenon. Fueled by social media, GameStop’s stock skyrocketed from around $20 per share to an eye-popping $483 in a matter of days, creating both massive gains and losses for those involved.

This sudden rise drew massive attention to GameStop, with Yahoo Finance among the platforms providing live updates and in-depth analysis. The story not only highlighted the power of retail investors but also raised important questions about market manipulation, short-selling, and the influence of social media on financial markets.

Understanding Yahoo Finance’s Role in Tracking GME

Yahoo Finance is one of the most well-known yahoo finance gme platforms for tracking stock market data, offering real-time prices, historical data, financial news, and in-depth stock analysis. For investors following GameStop, Yahoo Finance served as a hub of information, offering charts, technical analysis, and news articles on the stock’s performance.

Real-Time Stock Data and Updates

One of the key features of Yahoo Finance is its ability to provide real-time data on GME and other stocks. For investors watching GameStop, Yahoo Finance offered continuous updates on GME’s price movements, volume, and other crucial data points. These updates were particularly valuable during periods of extreme volatility, such as when GameStop’s stock was rising or falling sharply.

Investors could quickly see how GameStop’s yahoo finance gme stock price reacted to news stories, tweets from influential individuals, and Reddit posts. This helped retail investors make decisions in real-time, allowing them to capitalize on the volatile nature of GME’s stock.

In-depth Analysis and Historical Data

Beyond real-time prices, Yahoo Finance also offers historical data on GME’s stock performance. This includes a breakdown of GME’s stock prices over days, weeks, months, and years. By analyzing this data, investors could understand the stock’s long-term trends and its recent explosive growth. This historical perspective was critical for making informed decisions about whether to buy, hold, or sell GME shares.

In addition to stock prices, Yahoo Finance provides detailed financial analysis, including key performance indicators (KPIs), earnings reports, and future yahoo finance gme projections. These insights helped investors evaluate GameStop’s financial health, and many began questioning the true value of the stock, given the speculation and hype surrounding it.

News and Social Media Integration

Another key feature that set Yahoo Finance apart during the GameStop saga was its integration of news from various sources. Yahoo Finance aggregates yahoo finance gme news articles, analyst reports, and social media posts, making it a one-stop shop for anyone wanting to stay informed about the latest developments surrounding GME.

For example, when Elon Musk tweeted about GameStop or when other influential personalities shared their thoughts on the stock, Yahoo Finance quickly posted these updates. This helped amplify the effect of social media on GME’s stock price, further driving its volatility and the attention it garnered.

The GameStop Stock Volatility: A Roller Coaster Ride for Investors

The GameStop saga was marked by extreme volatility. yahoo finance gme The stock’s meteoric rise was followed by sharp declines, as institutional investors and short-sellers rushed to cover their positions. This back-and-forth movement created a whirlwind of opportunities for traders, but also significant risks.

The Short Squeeze

One of the most important factors driving the GME stock surge was the short squeeze. A short squeeze occurs when investors who have bet against a stock (through short-selling) are forced to buy back shares to cover their positions, which in turn drives the price even higher. In the case of GameStop, hedge funds and institutional investors had heavily shorted the stock, betting that its price would decline. However, as retail investors began buying up shares, the yahoo finance gme stock price surged, forcing those short sellers to scramble to buy shares and cover their losses.

The Role of Institutional Investors

The involvement of institutional investors, yahoo finance gme such as hedge funds, also played a critical role in the GameStop story. Many of these investors, having underestimated the power of retail traders, found themselves on the losing end of the short squeeze. As their losses mounted, the media and platforms like Yahoo Finance reported on the growing tension between Wall Street and retail investors. This battle became a central theme in the GME story and sparked broader debates about the fairness of the stock market and the influence of large institutions.

The Fallout and Regulatory Scrutiny

After the initial surge in GME’s stock price, the inevitable correction occurred, with the stock price falling from its peak. This sharp decline led to massive losses for those who had bought in at the height of the frenzy. As the dust settled, regulators began to take a closer look at the events surrounding GameStop’s rise. Investigations into market manipulation, trading practices, and the role of social media platforms became a major topic of discussion. yahoo finance gme Platforms like Yahoo Finance continued to report on these developments, providing investors with the latest updates on any potential legal or regulatory action that could impact GME’s future.

The Impact of GME on the Stock Market and Retail Investing

While the GameStop story was a yahoo finance gme unique one, its impact on the stock market and the way we think about retail investing is profound.

Empowering Retail Investors

One of the biggest takeaways from the GameStop saga is the newfound power of retail investors. The Reddit-fueled rise of GME demonstrated that individual traders, armed with social media and access to real-time stock data, could have a significant impact on the stock market. Platforms like Yahoo Finance made it easier for these investors to track trends, access financial news, and make informed decisions.

This power shift has yahoo finance gme led to a surge in retail trading, with more and more people entering the stock market, often with little prior experience. This has raised questions about whether traditional financial institutions are prepared for this new era of retail-driven investing.

Market Regulation and Transparency

yahoo finance gme The GameStop saga has also highlighted the need for greater transparency and regulation in the stock market. The role of short-selling, market manipulation, and the influence of social media on stock prices are all areas that could benefit from more stringent rules and oversight. As the SEC and other regulatory bodies continue to investigate the events surrounding GME, the industry is likely to see changes that could alter the landscape of retail investing.

The Future of Meme Stocks

GameStop’s stock is often referred to yahoo finance gme as a “meme stock,” a term used to describe stocks that gain popularity due to social media and online communities rather than fundamentals. While the GME phenomenon may have been a once-in-a-lifetime event, it’s clear that meme stocks are likely to remain a part of the investing landscape. Yahoo Finance and other platforms will continue to track these stocks and provide insights to investors looking to capitalize on the next big trend.

Conclusion: What Can We Learn from GameStop’s Wild Ride?

The GameStop story is one of yahoo finance gme the most extraordinary events in modern financial history. From a struggling retail chain to the focus of a global financial revolution, GameStop’s journey has changed the way we think about stock markets, social media’s role in investing, and the power of retail investors.

For those tracking GME, yahoo finance gme has been a crucial resource, providing real-time updates, financial news, and analysis that has helped investors navigate the stock’s dramatic rise and fall. The events surrounding GameStop have sparked important conversations about market fairness, transparency, and the role of social media in modern finance.

As we look to the future, the legacy of GameStop and its impact on retail investing will continue to shape the financial world. While yahoo finance gme stock may have cooled down, the lessons learned from this phenomenon will undoubtedly influence how investors, analysts, and platforms like Yahoo Finance approach the market for years to come.